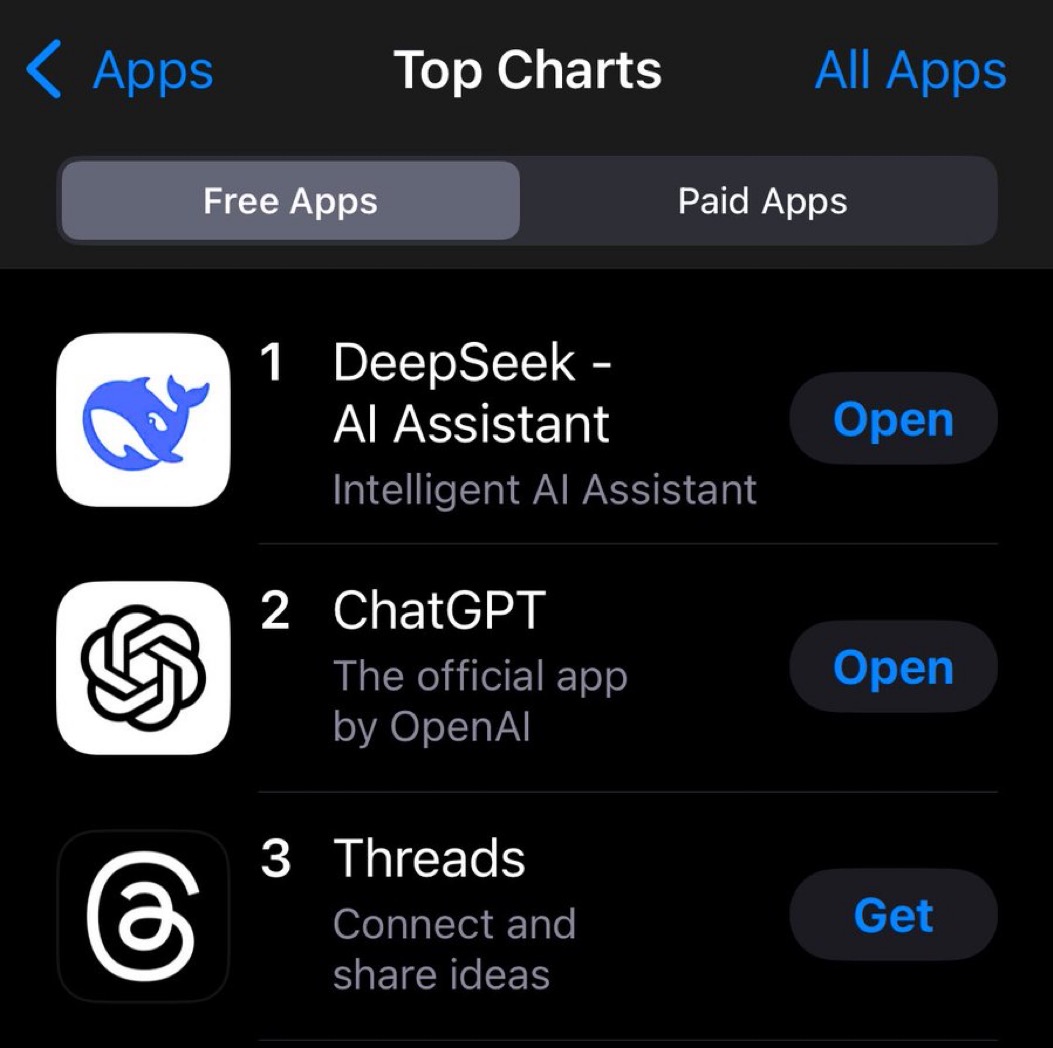

Fifteen days. That’s all it took for a small Chinese startup to dethrone ChatGPT on the U.S. App Store.

The name? DeepSeek.

The cost? $6M.

The impact? Massive.

This isn’t an article on whether you need to switch to DeepSeek or not.

If your goal is to serve India’s next 100 million users, your challenge isn’t lack of technology. It’s how you apply it. That’s where DeepSeek can teach us all a lesson.

What Makes DeepSeek-R1 Different

DeepSeek didn’t win because they outspent the giants. They won because they out-thought them.

1. Open Source, No Nonsense

DeepSeek doesn’t gatekeep. Their MIT license makes it a free-for-all:

- Use it commercially, without hidden fees.

- Customize it for unique use cases.

- Build directly on top of its architecture.

For fintech startups, this is freedom. Freedom from vendor lock-ins, opaque pricing, and walled gardens. It’s how small players level up against incumbents.

💡 Think about it: If you’re not paying exorbitant licensing fees, you’re redirecting that capital to innovation, scaling faster while the competition drowns in contracts.

2. Engineered for Results, Not Vanity

DeepSeek’s performance doesn’t come from raw power. It’s about purpose-built engineering:

- 92% accuracy in reasoning tests, outperforming GPT-4’s 78%

- Models purpose-built for specific tasks, not bloated with unnecessary complexity.

💡 This is fintech’s reality. You don’t need 175 billion parameters to detect fraud or onboard users. What you need are lean, highly efficient systems that are fast and reliable.

For example, a mid-sized NBFC deploying R1 for fraud detection could cut computational costs by 30% without sacrificing accuracy. That means faster loan disbursals and happier customers.

3. Built for the Real World

While GPT-4 gulps down fleets of A100s, DeepSeek runs efficiently on mid-range hardware like NVIDIA’s H800. The result?

- 40% lower training costs.

- AI that scales without draining your wallet.

💡 Translation for fintech: AI should be accessible to everyone, not just billion-dollar unicorns. DeepSeek proves you don’t need a massive tech stack to ship game-changing features.

DeepSeek’s Next Leap: Janus-Pro-7B

If R1 was about speed, Janus-Pro-7B is about ambition. This new multimodal model is capable of generating and interpreting images, smokes DALL-E 3 and Stable Diffusion on GenEval and DPG-Bench benchmarks.

Why does this matter for fintech? Because fintech isn’t just numbers. It’s visual, too.

Here’s how Janus-Pro-7B rewrites the rules:

Identity Verification Reimagined

Forget clunky KYC workflows that rely on humans squinting at scanned documents. Janus automates visual verification.

- Integrate Janus-Pro-7B into your onboarding flow to automate Aadhaar-based selfie verification, cutting rejection rates by 15%.

- Detect forged documents with pixel-level accuracy. This isn’t just faster onboarding, it’s fraud detection built into the pipeline.

Localization That Actually Connects

Janus goes beyond translation.

- Visual UIs tailored to regional preferences. Imagine payment apps that look like they were designed for Dindigul, not Silicon Valley.

- Generate infographics to explain financial products like mutual funds in local languages.

💡 Reality check: Localization isn’t just nice-to-have in India—it’s survival. Janus-Pro-7B turns it into a superpower.

Fraud Detection with Eyes and Brains

Pair Janus with R1, and you’re not just keeping up with fraudsters—you’re staying ten steps ahead.

- Spot tampered Aadhaar photos or fake invoices in milliseconds. No human reviewer can match that speed.

- Traditional systems catch one fraud attempt? Janus catches three more before they even hit your ops team.

- A 5-person fraud team can now deliver the precision of a 50-person operation, combining R1’s logic with Janus’s visual insights.

💡 POV: Fraud isn’t static, and neither are your defenses. The next wave of fintech fraud detection isn’t just smarter. It’s sharper, faster, and multimodal.

3 Practical Lessons for Fintech Builders

1. Move Beyond Rule Engines

Rule engines are dinosaurs. They’re rigid, expensive, and crumble under edge cases. DeepSeek swapped 20% of its rule-based code for AI, slashing costs and improving outcomes.

Here’s your fintech playbook:

- At Cashfree Payments, we’re building an AI-native identity stack with tools like SmartOCR, liveness detection, and video KYC to tackle issues like bad quality or fake images (e.g., glare, blurred photos). Reduce processing times from 48 hours to 8 minutes.

- Train AI to flag high-risk behaviors in real time. Unusual UPI activity? Suspicious login patterns? Spot them before they escalate.

💡 Reminder: Reliability is critical in fintech. A single failed transaction can erode trust forever. Build systems that are fast but fail-safe.

2. Solve the Language Gap, Now

Your users are leaving. Why? Because they don’t feel heard. 37% of Indian fintech users abandon apps due to language barriers, not because your product isn’t good enough, but because it doesn’t speak their language.

What will you do about it?

DeepSeek cracked this by natively supporting 130+ languages without cutting corners.

Your next move?

- Integrate Janus and R1 into voice-based interfaces so kirana store owners can navigate repayment terms in their own language, building trust and clarity.

- Translate critical workflows like loan agreements, payment confirmations, and onboarding flows into Tamil, Marathi, and Bengali.

- Train AI on hyper-local financial terms like “Kirana credit” and “chit fund” because these aren’t the same as “fixed deposit.”

💡 My POV: Localization isn’t about features. It’s about aligning with your user’s reality. When you solve their problems in their context, you win their loyalty.

3. Open Source = Open Innovation

DeepSeek’s most surprising edge? Its open-source community contributed 30% of its fraud-detection code.

For fintech builders, open source is not just a cost-saver. It’s a growth driver.

- Open-source non-core modules like Payment failure classifiers, Webhook management. Share them and build goodwill.

- Collaborate with ecosystems like RBI Innovation Hub to crowdsource fraud patterns.

- Offer tangible incentives such as equity, bonuses, or recognition for contributors who improve your system.

💡 Big Picture: Open source isn’t about cutting corners. It’s about building a stronger ecosystem where the product and everyone in it gets better over time.

One Thing to Watch: Compliance

DeepSeek’s story isn’t without controversy. They’re accused of training on ChatGPT outputs, potentially violating OpenAI’s terms.

For fintechs, this is a timely reminder that compliance must always stay front and center:

- Explicit consent. Never train on customer data without Account Aggregator-compliant permissions.

- Vendor audits. Review all third-party partnerships quarterly to stay ahead of SEBI and RBI guidelines.

💡 Key Insight: In fintech, innovation must go hand-in-hand with accountability. Compliance isn’t optional. It’s foundational to building trust.

Why This Matters for Fintech Builders

India’s digital infrastructure is unmatched: UPI, Digilocker, Account Aggregators. It’s a massive opportunity waiting to be leveraged by fintech innovators.

Here’s how you can take it further:

- Pilot locally. Use BharatGPT, an open-source AI optimized for India, to design workflows for underserved regions.

- Focus on real lives. Features are easy to copy. Execution isn’t. Build tools that make a tangible difference, whether it’s enabling small merchants with voice alerts or translating loan agreements into native languages.

💡 The Takeaway: Fintech’s future won’t be written by those with the biggest budgets. It will be built by those who understand their users deeply, iterate fearlessly, and fully leverage India’s unique infrastructure.

India’s fintech future will be written by builders who think big but act small, understanding the lives of users at every step.

Now It’s Your Move.

Will you cling to the old playbook or, rewrite it?